House price growth dips; mortgage approvals peak; and the impact of the stamp duty holiday laid bare.

House price growth showed its first signs of cooling in January as wintry weather and the third national lockdown gave buyers and sellers pause for thought.

On a monthly basis, house prices were 0.3% lower in January 2021 then they were in December 2020, according to Halifax.

The monthly fall was the biggest since April of last year, during the first national lockdown and temporary closure of the housing market. The drop meant that UK house prices were 5.4% higher in January 2021 than they were a year ago.

Nationwide reported a similar pattern, with UK house prices down 0.3% in January, which it said reflected falling demand ahead of the stamp duty holiday cut-off at the end of March. The lender said it was is the first monthly decline since June and capped the annual growth rate at 6.4%, compared with 7.3% in December.

RICS’ latest market survey found enquiries, sales and new instructions fell for the first time since May 2020 last month. A net balance of -28% of survey respondents reported a decline in new buyer enquires in January, with a fall in new listings too (net balance of -38%). Despite this, upward pressure on prices continued across the UK with the exception of London, which recorded a net a balance of -9.

Mortgage approvals data covering the quarter to December 2020 also showed a slowdown, with 103,400 loans approved for house purchase in the final month of 2020 compared with 105,300 in November. This was the first fall in seven months, although year on year transactions in December 2020 were 32.1% higher than December 2019.

Despite initial signs of a slowdown, there remains significant momentum in the UK housing market, with 818,500 mortgage approvals for house purchase in 2020 compared to 789,100 in 2019. This was even more remarkable given that house purchase approvals hit a record low of 9,400 in May 2020, as the eight-week shutdown of the market took its toll.

Ahead of the Budget on 3 March it gives Chancellor Rishi Sunak food for thought. To date he has signalled that he has no intention of extending his support to the housing market, with the stamp duty holiday in England and Northern Ireland due to end on the 31 March.

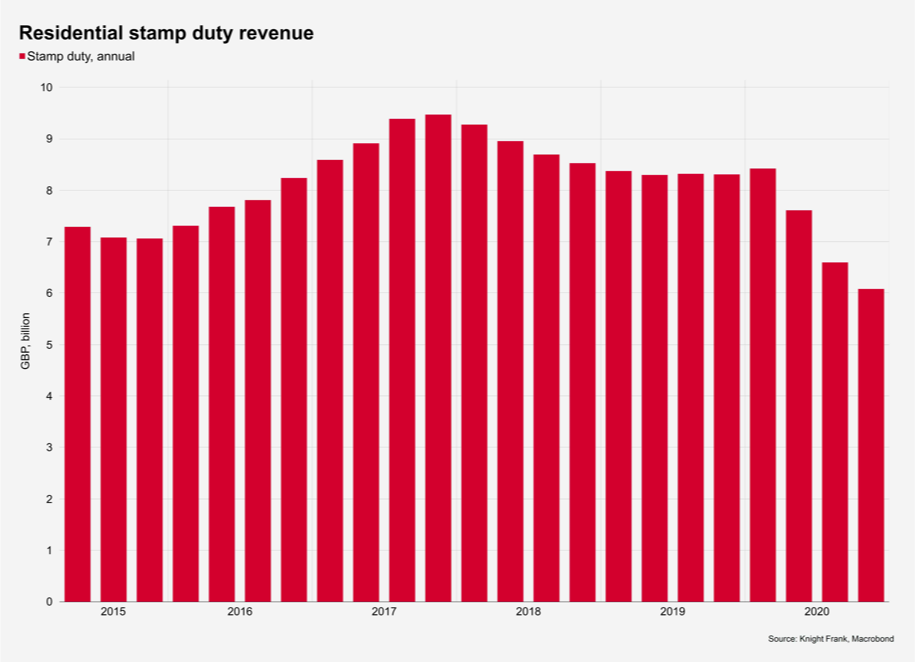

The SDLT holiday, which was introduced in July 2020, increased the threshold at which duty is paid on a property purchase from £125,000 to £500,000. Consequently, in Q4 2020 residential receipts were £1.8bn, down from £2.3bn during the same period in 2019. This was despite an increase in residential property transactions in Q4 2020, which were 44% higher than in Q3 2020, underlining the impact of the duty holiday.

It meant that for 2020, residential receipts stood at £6.1bn, which was 27% down on the £8.3bn raised in 2019. During this period, £1 million-plus sales increased by 11% on an annual basis to 19,800 compared with 17,900 in 2019. High value properties were the strongest performers in the Prime Country House Index in 2020.

Prime London Sales

House prices in prime central London (PCL) declined 4.3% during the year to January amid the prevailing restrictions on travel. Despite this, the number of transactions in PCL was 12% higher in January than the same month last year, highlighting how the release of pent-up demand after the market re-opened last May is translating into exchanges.

The data also reveals the differing reliance on domestic and overseas buyers across various markets. The spread between the annual price growth in Greater London (9.6%) and PCL (-4.3%) in November was 13.9 percentage points, underlining the extent to which domestic demand has sprung back in the capital.

This relatively weaker performance in PCL comes ahead of a 2% stamp duty surcharge for overseas buyers in April. However, the recent absence of international travellers suggests the stamp duty surcharge will be largely baked into prices before it is introduced.

Prime London Lettings

Average rents in prime central London fell 13% in the year to January amid high levels of supply.

The trend was less marked in prime outer London, where rents fell by 10.7% in the year to January. The declines have been smaller in some leafier parts of London, where the supply of lettings property has been kept in check by a relatively buoyant sales market.

The number of market valuation appraisals for the lettings market rose by 63% versus the five-year average in January, highlighting how supply levels continue to rise. The number of tenancies started in January was 19% ahead of the five-year average in London, underlining how activity levels remain strong despite falling rents.

Country Market

The traditional seasonal slowdown ahead of the spring market has combined with the third national lockdown and concerns about the new Covid-19 variants, as well as the need to for many to home school, to dampen activity.

While new prospective buyers registering with Knight Frank in the country market were 8% ahead of the five-year average in January, supply is constrained after 2020’s record-breaking run.

Viewings were 14% down in January versus the five-year average, and with some sellers seemingly holding off for the spring market and an improvement in sentiment as vaccines roll-out, appraisals for sale fell 50% in January 2021 versus the five-year average.

However, last year’s momentum means that offers accepted were up 83% and exchanges up 76% versus the five-year average.

Read the original post here.