Residential property market begins journey back to normality

After a record June for the UK residential property market and the start of the holiday season, it was of little surprise that activity moderated in July.

A record 198,240 transactions took place across the UK in June, according to provisional data from HMRC. This mirrored Knight Frank’s experience during the month.

However, the number of UK exchanges in July was 21% below the five-year average according to Knight Frank data. Official data for the month is expected to show a similar movement.

Demand has outpaced supply throughout this year, and while the former has remained strong even with the passing of the stamp duty holiday deadline on 30 June, the current imbalance should ease in the autumn as the market normalises.

Sellers put off by the record-breaking activity are expected to return to the market, as seasonal patterns re-establish themselves and the stamp duty holiday, which is being tapered, ends on 30 September.

There are signs this is happening already. The Nationwide House Price Index fell back to annual growth of 10.5% in July from 13.4% in June. Annual growth according to Halifax was 7.6% last month compared to 8.7% in June.

The latest sentiment survey from RICS, found activity had cooled in July with new buyer enquiries and newly agreed sales down. However, tight supply should keep upward pressure on prices. The net balance of -46 for new instructions was the weakest reading since April 2020 and the fourth consecutive month of decline, according to RICS. Two-thirds of survey respondents expect average prices to be higher in a year’s time (compared with +56 in June).

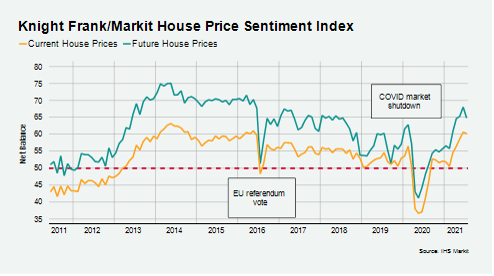

According to the IHS Markit Sentiment Index there was a slight drop in confidence in July (see chart). The readings for both current and future house prices were down. However, they remain well above their pre-pandemic levels, suggesting households remain positive about pricing.

Data released in July by the Bank of England, revealed that while net mortgage borrowing reached a record high of £17.9bn in June, mortgage approvals for home purchase were 81,300, down 6.4% from 86,900 in May. Despite this, approvals remain significantly higher than the pre-pandemic average of 66,242 (year to March 2020).

Prime London Sales

After a record month for the prime London property market in June, it was no surprise that transaction volumes dipped in July as the stamp duty holiday began to wind down.

The number of sales in London was 20% below the five-year average in July (excluding 2020) but this decline was skewed towards lower price brackets.

Below £1 million, the drop was 39%, underlining the proportionately larger impact of the maximum £15,000 stamp duty saving. Above £2 million, the number of transactions was 3% higher than the five-year average in July.

Annual price growth in prime central London was 0.8% in July, the highest figure since May 2016. In prime outer London, annual growth was 3.1% for the third consecutive month.

Prime London Sales Report: July 2021

Prime London Lettings

The lettings market in London and the Home Counties continued its journey back towards normality in July.

Rental values rose month-on-month for the first time since the start of the pandemic, as the steep declines experienced over the last 17 months begin to reverse.

There was an increase of 0.2% in prime central London, meaning the annual decline narrowed to -10.5%. In prime outer London, the same monthly rise meant the annual fall was 7.6%, the lowest it has been since September 2020.

As supply becomes tighter and demand continues to strengthen, upwards pressure on rental values will intensify in the second half of the year. Knight Frank forecasts that rents will end the year flat in both prime central and outer London as the bounce back from the pandemic gathers pace.

Prime London Lettings Report: July

Country Market

With record transactions in the country market during June, average prices grew at their strongest rates since the global financial crisis in both Scotland and England’s country house markets. This was supported by limited supply due to the challenges of the third national lockdown at the start of the year, and the distortions caused by the stamp duty holiday.

In the country market, average values increased by 3.7% in the three months to June, which was the strongest rate of quarterly growth in 15 years. It means average prices are 10.5% higher than a year ago, which is the strongest rate of annual growth since Q1 2007.

In Scotland average prices increased by 5.5% during the three months to June, the strongest quarterly performance since Q2 2007. Annual growth was 5.7%, which was the highest figure since Q4 2007. Price growth in Edinburgh was at a three-year high in the second quarter of the year as demand for more living space continued to drive the market.

Read the original post here.