Summary:

- Bali’s track-record of rebounding after past crises indicate potential for a V-shape or U-shape economic recovery assuming the COVID-19 outbreak is not protracted

- Pent-up travel demand will be the leading factor towards strong recovery in the hospitality and tourism sector; similar to after SARS in 2003 and volcanic eruptions from 2017 to 2019

- Hospitality property prices in Bali are likely to strengthen post COVID-19; partial investment in hotels by renowned operators would be a practical approach to investing in Bali’s hospitality real estate

- The Wealth Report 2020 by Knight Frank outlined a projected 57% increase, or 1,060 individuals, in Indonesian ultra-rich over the next four years, driving demand for Bali properties

Hospitality properties have long appealed to investors due to higher yields over residential properties. Globalisation facilitated greater accessibility to travelling across the South-East Asian region, further spurring growth and demand for hospitality real estate.

The COVID-19 outbreak dealt a strong blow to the sector – social distancing measures, city lockdowns and travel restrictions – deferring the plans of prospective investors to the backburner.

While retail investors are likely to retreat towards investing in “safer” assets such as government bonds during such times of adversity, contrarians may target assets that are likely to rebound in value once the pandemic has abated. Hospitality properties, especially in tourism hotspots such as Bali, belong to such an asset class with the potential for a rebound.

Bali remains a top tourist destination, with pent-up demand and expected strong recovery

Ranked the top travel destination by TripAdvisor’s Travellors’ Choice Award in 2017, Bali has historically been resilient against downturns and could recover within a year of the outbreak being over. When travel plans resume after COVID-19, Bali is expected to retain its attraction to a variety of visitors; from beachlovers and surfing enthusiasts, to xenophiles and aspiring social media influencers pursuing its “Instagrammable” spots.

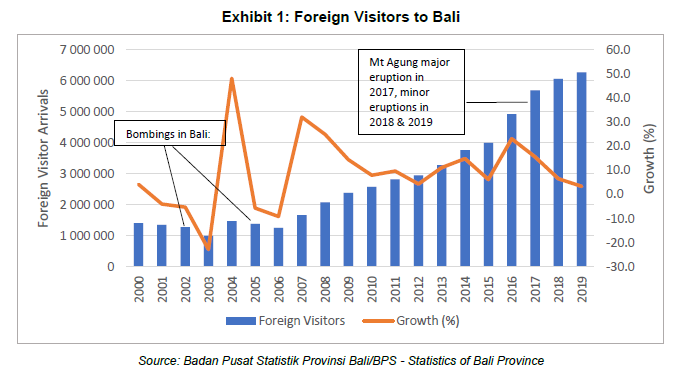

The SARS outbreak in 2003 resulted in a reduction of Bali’s foreign visitors by 22.8%, where it hosted 993,185 visitors. The following year, foreign visitors to Bali recovered by 48.2% (Exhibit 1).

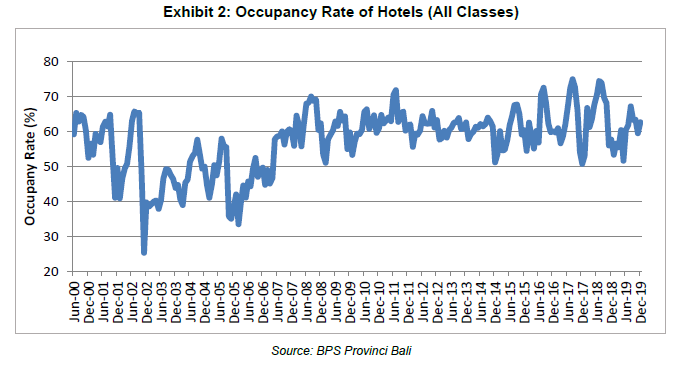

Occupancy rates sharply rebounded during this recovery, alongside an increase in the supply of hotels. Since then, occupancy rates have mostly remained stable (Exhibit 2). Notably, visitor arrivals appeared not to have been affected by the volcanic eruptions from 2017 to 2019.

These considerations indicate that Bali could likely experience a V-shape recovery presuming that the COVID-19 pandemic is not protracted.1

Domestic visitors are expected to continue growing, encouraged by Indonesia’s rise in ultra-rich individuals and the flourishing start-up scene

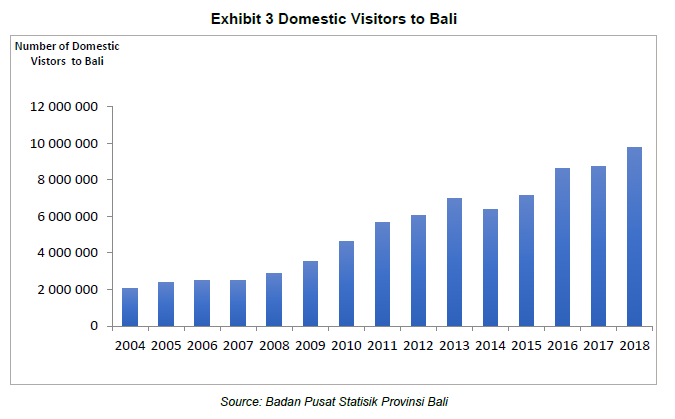

Indonesia’s population of more than 265 million presents a vast local tourism market with a steadily increasing middle-class demographic. The number of domestic visitors grew from 8.7 million in 2017 to almost 9.8 million in 2018 (Exhibit 3). Hotel Investment Strategies LLC forecasts domestic visitor arrivals to reach 12.9 million by 2023.

The expected growth post COVID-19 will likely see the number of Indonesia’s ultra-rich individuals to jump by 57% over the next four years, the second-highest increase in Southeast Asia, reflected by the Knight Frank Wealth Report 2020.

The growth of Indonesia’s ultra-high-net-worth individuals (UHNWI; or those with a net worth of more than US$30 million), is projected to be the fifth highest in the world. This translates to sustained demand for real estate in Bali, given its international appeal.

Additionally, the Wealth Report 2020 publication indicated that approximately 70% of wealth managers in Asia were actively adjusting their clients’ portfolios in response to the global economic slowdown, with about 28% of investment portfolios allocated to the property sector. Bali’s hospitality properties are likely recommendations to the portfolio restructure.

The emergence of Indonesia’s start-up scene will drive domestic travel towards Bali. Canggu and Ubud are emerging hotspots for digital nomads, recommended by Nomadlist.com as an upcoming destination, further magnetising technology-savvy millennial workers towards Bali.

Investing with renowned hotel operators is a more practical approach

The uncertainty influenced by the COVID-19 pandemic may lull buyers into seeking bargain-level hospitality properties, which is unlikely as most hotel owners have strong financial backing with the ability to ride out the tide. In addition, hotels in Bali are rarely offered to retail investors, nor will their prices decrease substantially.

Conversely, as the fog clears around global travel restrictions and social distancing measures, prices are likely to rise in view of pent-up travel demand.

Options for retail investors to own a hotel in Bali are limited. While there may be distressed residential properties available in the market, existing restrictions to property ownership remain for foreigners to buy one. Additionally, the lack of access to local networks in property management poses additional investment challenges. Hence, purchasing a share of the hotel operated by a renowned operator helps to offset the risk; a more practical investment approach.

Hotels that are on track to completion have an advantage against those in the early phases of construction. Others in planning stages will experience an extended timeline due to supply chain disruption of construction materials, shortage of human resources and social distancing measures.

The Lifestyle Pursuit

Over the last 20 years, Bali has enjoyed a substantial growing pool of domestic visitors from across Indonesia and an influx of international visitors.

Bali is no stranger to unexpected crises and disasters, with its history fraught with terror attacks, volcanic eruptions and pandemics. It has repeatedly proven its ability to recover and strengthen from each setback, and its expected rebound from COVID-19 is no exception.

As the world, including Indonesia, adjusts to lifestyle changes, digital nomads will resume their remote lifestyles, while the affluent pursue quality living.

Bali offers the best of both worlds that digital nomads and affluent visitors appreciate – low cost of living and high quality of life – pointing to optimistic signs for investors to capitalise on its hospitality real estate.

Connect with us for a free consultation on investing in Bali’s hospitality real estate.

1McKinsey reported that most leaders expect the recovery to be either V-shaped or U-shaped. The Harvard Business Review commented that the V-shaped recovery characterised previous pandemics, while the plausible U-shaped recovery will result in permanent structural changes and productivity decline. The most pessimistic L-shaped scenario is less likely.

References:

Knight Frank, “The Wealth Report 2020”,<https://www.knightfrank.com/wealthreport>

Hotel Investment Strategies, “Upsurge in domestic visitors to Bali in 2018 – 12.9m forecast for 2023,” viewed 20 May 2020,

<http://hotelinvestmentstrategies.com/upsurge-in-domestic-visitors-to-bali-in-2018-12-9-m-forecast-for-2023/>

Harvard Business Review, “What coronavirus could mean for the global economy,” viewed 20 May 2020,

<https://hbr.org/2020/03/what-coronavirus-could-mean-for-the-global-economy>

ANTARA News, “Indonesia’s digital economy projected to emerge 9th-largest globally,” viewed 20 May 2020,

<https://en.antaranews.com/news/141498/indonesias-digital-economy-projected-to-emerge-9th-largest-globally>