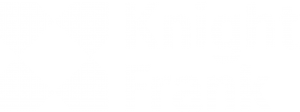

First introduced in December 2011, the Additional Buyer Stamp Duty (ABSD) is a useful solution to control the spikes in property prices, which has been an issue due to the increase in property purchases by foreigners and entities. Often than not, property investors will need to factor this into their investment decisions as this will have an impact on the cost to transact and eventually ones overall return on the investment.

The most recent cooling measure pushed forward by the government was announced in June 2018, where the ABSD was raised and the loan-to-value (LTV) limits on residential property purchases were tightened. It was enforced several days after official data showed private home prices had risen to its peak in the past four years from April to June quarter 2018, where analyst predicted that prices might recover to 2013 peak levels.

Since then, many Singaporean investors have placed buying a second home within our borders on a close lookout, always monitoring the markets and the imposable taxes.

Can you really afford your next investment property in Singapore?

For investors looking to purchase a second home in Singapore, here are some taxes due for consideration;

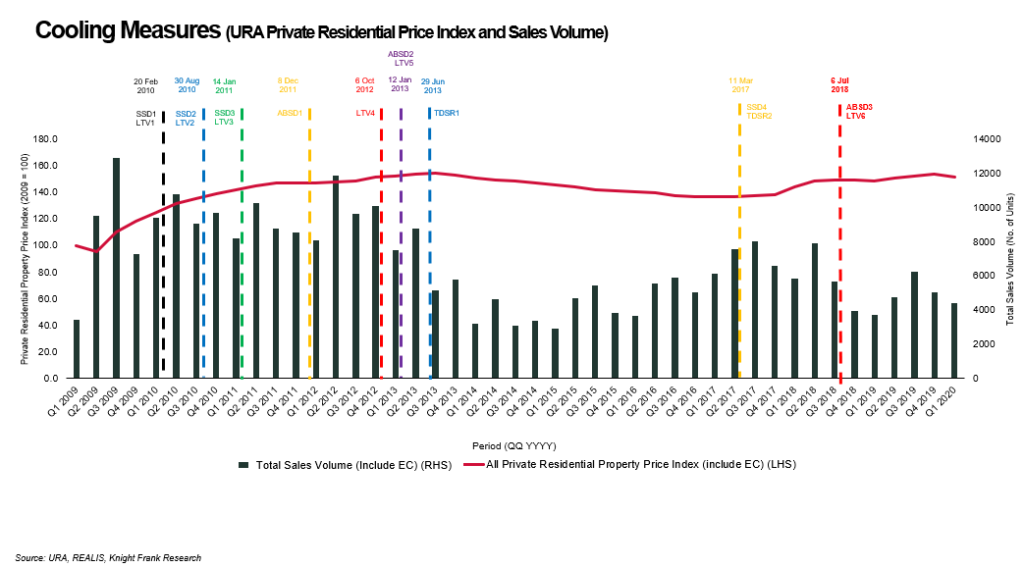

1. Buyer Stamp Duty (BSD)

A fundamental tax that all property buyers are subjected to is the BSD, which applies to all documents required for the transfer or sale and purchase of properties located in Singapore.

The BSD is computed based on the purchase price stated in the sale documents or can even be based on the market value of the property, whichever the higher amount. Read more on BSD on IRAS’ website.

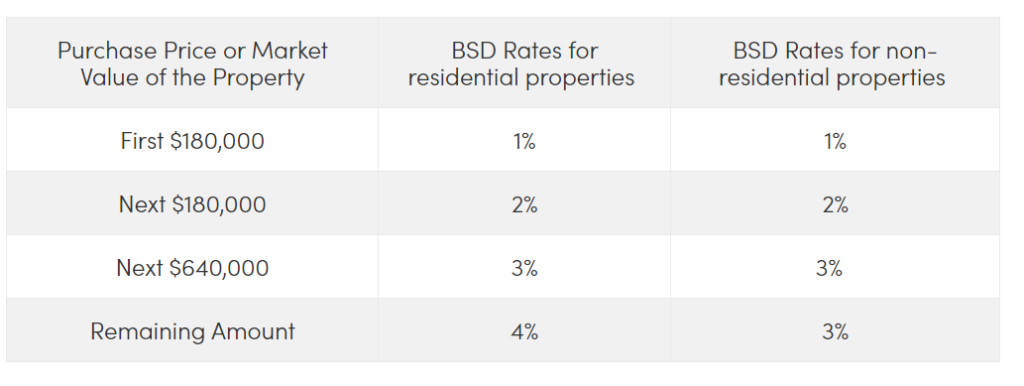

2. Additional Buyer Stamp Duty (ABSD)

Depending on the investor’s nationality on the date of purchase, the ABSD would be applicable based on several variables across the number of properties owned. Read more on the ABSD on IRAS’ website.

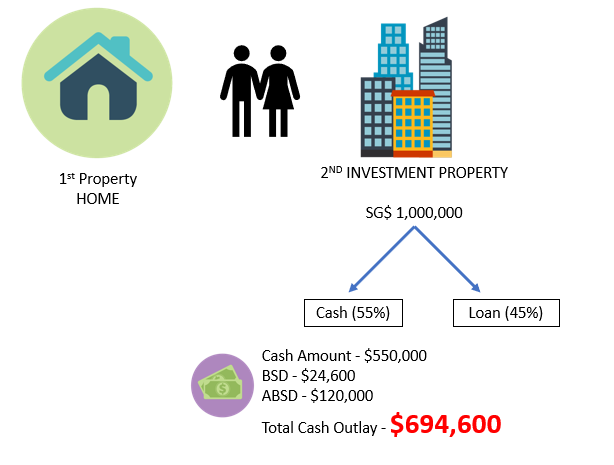

Considering these requirements and a typical investor’s profile, the average cash outlay required to invest in a second property in Singapore is a whooping S$700,000. Here is a simple illustration to show the impact of taxes in Singapore when purchasing a second investment property:

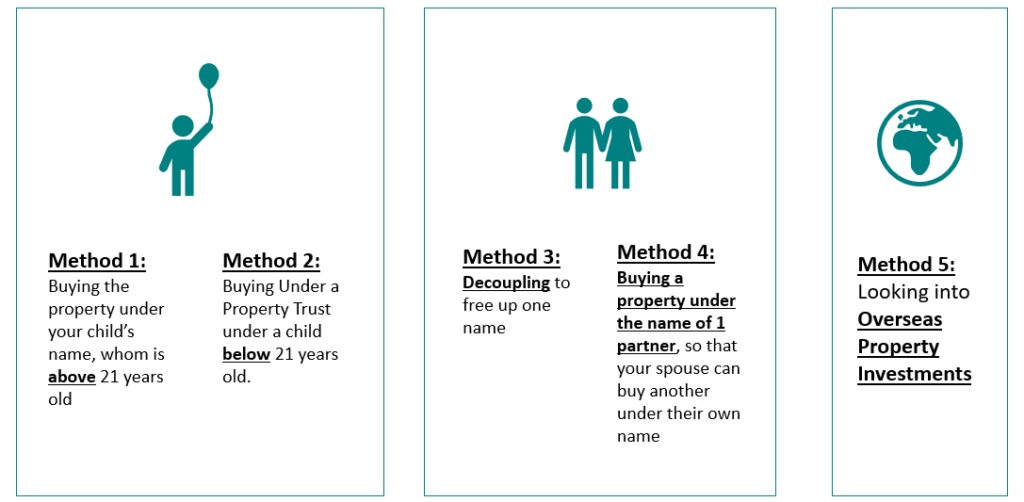

How Can One Save on ABSD and Still Own a Diverse Portfolio of Properties?

Even if one door closes, another opens. Here are five ways that sophisticated investors can consider to reduce the impact of ABSD on your property value:

Venturing into the international property market has generally been a preferred choice amongst Singaporean investors as markets abroad can offer lower barriers to entry, allowing investors the ability to diversify their portfolios and own investment properties abroad efficiently. On one hand, it typically requires a significantly lesser cash down payment as compared to purchasing a second property in Singapore, and diversifying has naturally always been a healthy solution when balancing owns own portfolio, spreading the risks across markets, especially in the long run. Not only that, international markets can offer an array of opportunities that could better suit the investors’ appetite and requirements.

Diversification – Expand Your Horizons and Look Overseas

In such as situation, our preferred choice is to look into the international markets and search for opportunities in trustable projects. In our previous article, we highlighted key locations where Singaporeans are buying across the globe, as well as the main reasons why Singaporeans choose to look overseas. In this article, let us compare Singapore’s market with exquisite London.

Rich in culture and history complemented with world-class museums, world-renowned neighbourhoods and a variety of shopping and food options, London is unlike any other city in the world. The city’s urban fabric gilds an alluring charm irreplaceable in the hearts of locals and travellers, well-loved for its authentic British lifestyle and dynamic zest. It is home to the world’s leading financial hub with some of the best educational institutions available globally.

In Singapore’s context, we share the same language and common law system which makes transactions safe, enforceable and familiar, and to no doubt it is one of the most favoured locations for Singaporean investors. Furthermore, London held one of the strongest track records in the world regardless of the economic conditions, while offering excellent infrastructure and a transparent legal system. One stark difference that sets London and Singapore apart for second-home investors is the tax regulations applicable.

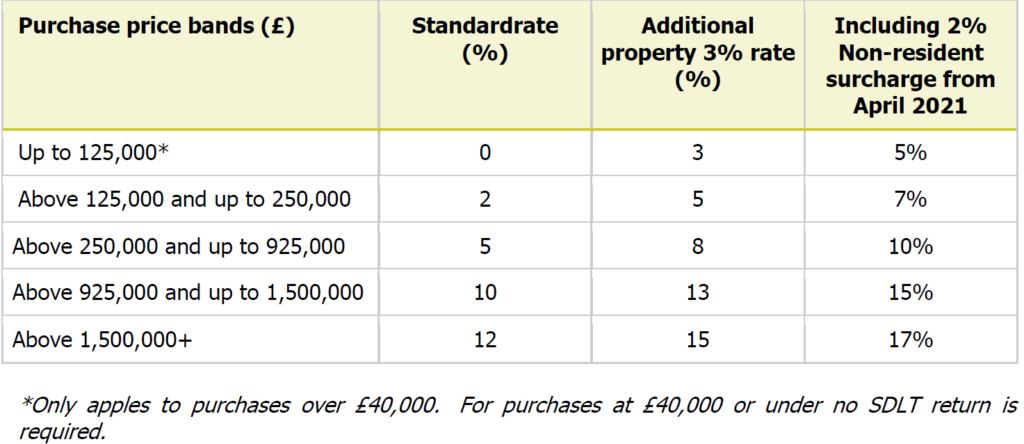

UK Stamp Duty

One thing to note is that a potential 2% stamp duty surcharge is applicable for non-resident buyers from April 2021 onwards. For investors who are purchasing their first residential property worldwide, the supplementary 2% increase would be added onto the standard rate. Further clarifications would be made by the UK government, so be sure to stay updated on the revision.

The stamp duty for a second property purchase applies to everyone regardless of citizenship, which levels the playing field for UK residents and overseas property buyers.

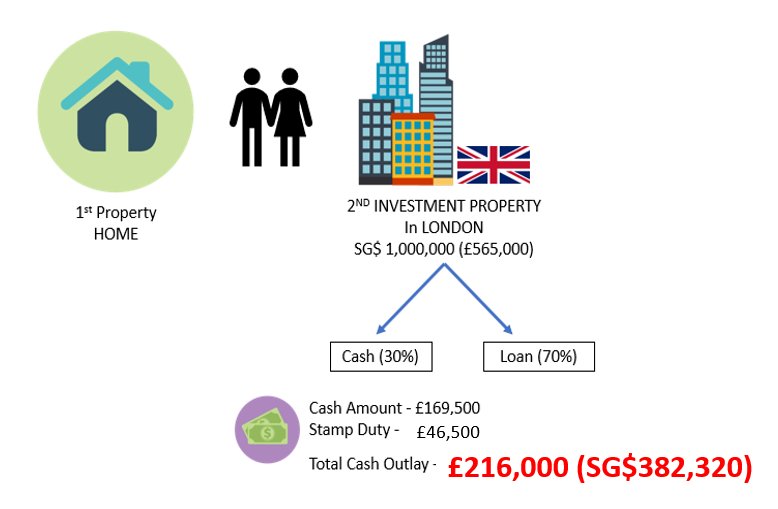

Taking the same example of a property valued at S$1 million into London’s market with an LTV of up to 70%, a much lower initial cash outlay is required for your London investment as compared to Singapore.

The total cash outlay required for a property of the same value in London is estimated to be S$383,000 as compared to a whooping S$700,000 in Singapore. Considering the rental yields in both contexts, Singapore properties can typically generate a 2.5% on average, whereas London rental yields can range from 3.5% – 5%. With a lower cash outlay and the ability to retain the most out of the property value, looking into the London market can be a much digestible option for investors who prefer a less hefty down payment.

We love to help. Chat with Us.

If you enjoyed this short read and would like to learn more about opportunities in London or abroad, we’d love to help. Chat with us on WhatsApp and fill in the form below.