Bali’s tourism scene has always been considered an enviable phenomenon, with over 16 million international and domestic tourists visiting the Island of the Gods annually; and the numbers don’t seem to be dwindling. Out of Indonesia’s 17,000 islands, Bali contributes more than one-third of all foreign arrivals to Indonesia. With its cultural distinctiveness complemented with its natural stunning landscapes, it is undeniable that Bali remains as a top global tourist hotspot that is set to grow year after year.

What comes to mind when you think about Bali? It could be the amazing shores and breath-taking beach experiences, or the immaculate service, or the relaxing spa boutiques and yoga sanctuaries. It could also be the affordable yet delicious and wholesome meals, or the company you get while enjoying the sunsets, but these offerings sparked a tourism boom unlike anywhere else in the world, and it effectively transformed Bali into one of Indonesia’s wealthiest regions. Bali has become one of the hottest global property investment hotspots, especially in recent years. Now, it is garnering a reputation for being a heaven for digital entrepreneurs around the world to settle in Bali to live, work, play and create.

The island offers a conducive environment for many professions, such as writers, programmers, designers, website developers, photographers, to do work remotely from anywhere and everywhere. Offering ideal co-working spaces for working and collaboration, and co-living spaces for the solo travellers, its quality of life and affordable costs of living allows digital nomads to settle in almost immediately.

With the strong demand for co-working and co-living spaces, there has been a stiff competition for global and local investors to dip their hands on a piece of this golden pot. Retail components such as restaurants, aesthetic cafes, stunning boutiques and beach bars have intensified over the years to meet the rising demand of the locals and tourists. Indonesia has also attracted foreign opportunities of all calibres, with Singapore being Indonesia’s biggest investor.

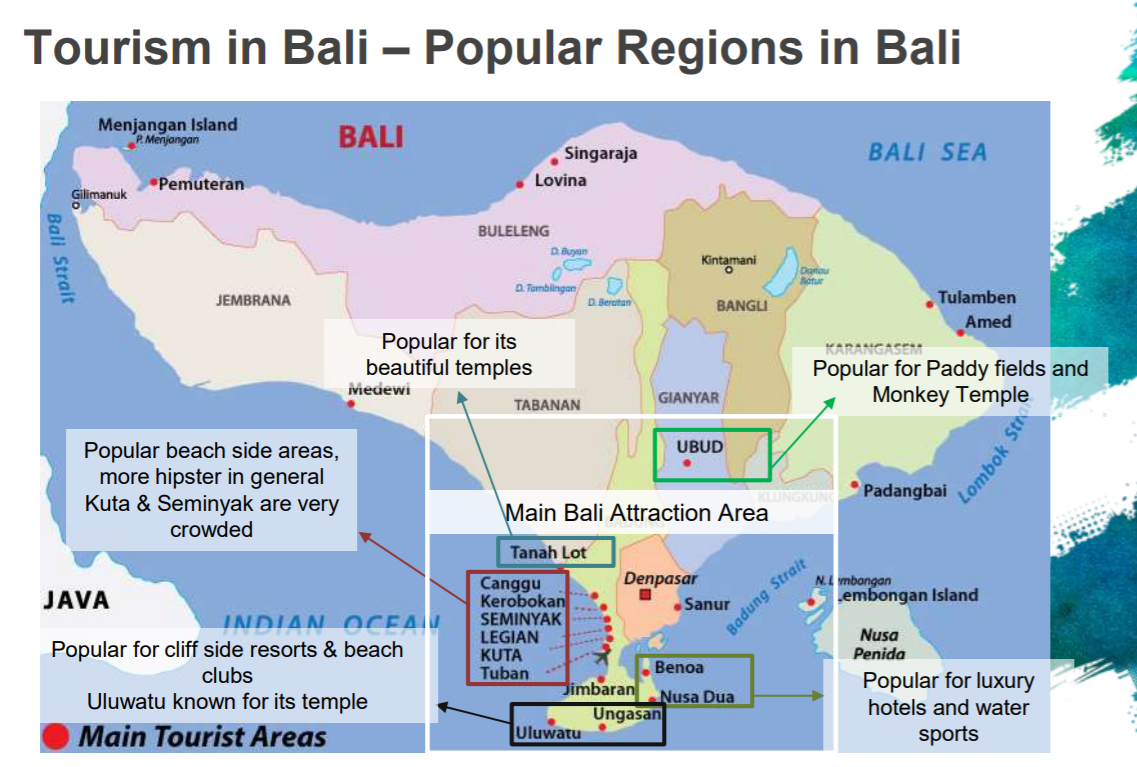

Hospitality investments are pouring into Indonesia, especially Bali. The hotel hotspots are concentrated near the airport, especially in popular neighbourhoods such as Nusa Dua, Benoa, Kuta, Legian and Seminyak. Bali’s hotel market is experiencing strong economic growth with more supply to be built. Developers have been acquiring land to build hotels further up north along the coastline – Canggu. This area is fast evolving into Bali’s hippest beachside scene, with a laid-back vibe, numerous eateries, vibrant venues, yoga studios, spas and some chic boutiques all conveniently nearby.

Occupancy rates have risen in tandem with the increase in room rates, along with the average receivable revenue per available (RevPAR) as well. The occupancy rate for hotels in Bali on an average is close to 90 percent. A top tip to note is that if you plan to visit Bali during the peak seasons, do be reminded to book your accommodation in advance.

Due to the various height and zoning restrictions during construction, developers would find it challenging and competitive to build new hotels and villas, and available land in prime beachfront locations have been experiencing an increasing intensity of scarcity especially during recent years, which has been one of the major factors in driving up land prices. Bali has the highest rate of increase of land prices in Indonesia. According to research, the average land prices in Bali recorded the highest jump of 34 percent in 2011, while the year on year increase rates ranged from 8 to 16 percent.

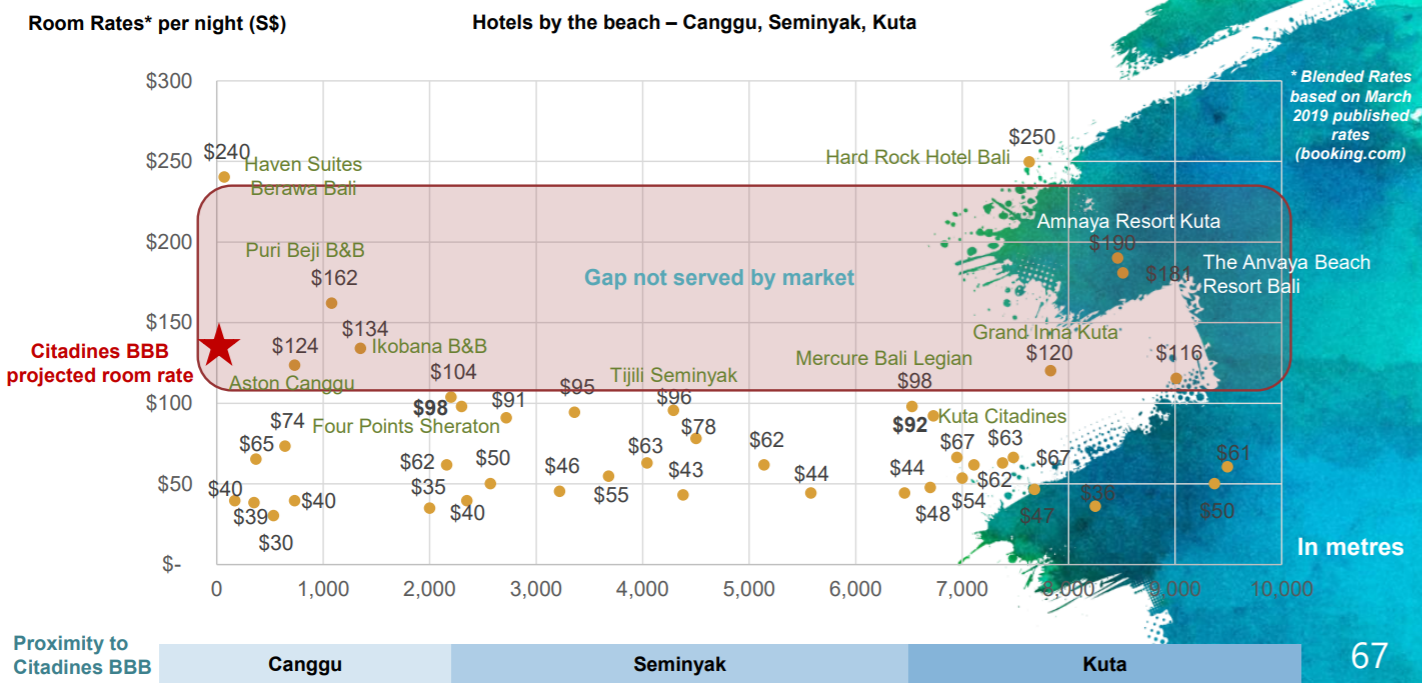

Amongst the hotels in Canggu, there has been a shortage in the 3-star and 4-star categories to cater to travelers whom are budget sensitive. Consider this; to build a reputable 3- or 4-star hotel today, a huge chunk of investment capital is required to even facilitate the idea. As an individual property investor, what options or opportunities can you take advantage of to capture such an enticing market?

Here’s what some of our clients have to say, based on their past experiences:

My first time investing in overseas property and I’m glad I started with something small and manageable. Most importantly, I’d like to have recurring passive income without feeling stretched.

I would say look out for opportunities from reputable developers and operators that you can take advantage of. I was convinced by an opportunity that offers a comparably low cash outlay, good management by The Ascott Group, stable tourism growth in Bali and the attractive beach-side location. We thought since we travel to Bali so often, especially Canggu, we might as well invest our money in a reputable hospitality brand operating on a global scale, at the same time earn passive income and utilize the 30 nights free stay whenever we visit.

If you’re keen on exploring an opportunity with Citadines Berawa Beach Bali, simply fill up the form and one of our trusted Knight Frank advisors will get in touch with you soon. In the meantime, check out the other content that we have on Bali over here and here as well.

Don’t forget to subscribe to our newsletter at the bottom of the page to get regular updates on market insights.

Disclaimer: Knight Frank Pte Ltd 10 Collyer Quay #08-01 Ocean Financial Centre Singapore 049315. Estate Agents Licence No. L3005536J. All forms of investments carry risks, including the risk of losing all of the invested amount. Such activities may not be suitable for everyone. This is an overseas investment. As overseas investments carry additional financial, regulatory and legal risks, investors are advised to do the necessary checks and research on the investment beforehand. Info is accurate as at 21 June 2019 & prices are indicative/”while stock last basis”. Images are computer generated as per artist’s impression. *Rental guarantee is provided by the developer (PT. GIJ Property Indo) and it will be stated and formed as part of the sales and purchase agreement. PT. Ascott International Management Indonesia as the management of the Serviced Residence will not be responsible for any rental guarantee. *Investor’s name has been changed to protect his privacy and interests. Construction License Number: 258/IMB/DPMTSP/2019